Featured

Ole Miss Alumni Review: Industry Innovators

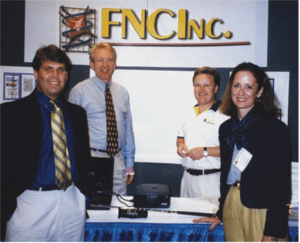

Bob Dorsey (left), John Johnson, Dennis Tosh and Bill Rayburn

This story was reprinted with permission of the Ole Miss Alumni Review.

One day in 1995, a few men huddled around a table at McAlister’s in Oxford, fleshing out a plan on a napkin. The improvised stationery would have to do. The idea just couldn’t wait.

One day in 1995, a few men huddled around a table at McAlister’s in Oxford, fleshing out a plan on a napkin. The improvised stationery would have to do. The idea just couldn’t wait.

The schematic jotted down in the restaurant that day was the blueprint for a new company

that would transform the real estate appraisals process for banks and become the industry leader in electronic appraisal management systems. Jokingly called “Four Nerds with Computers,” but later FNC, the company would sell for $475 million 20 years after that first meeting.

Four University of Mississippi School of Business Administration professors and one Ph.D. student drafted the plan for Financial Neural Computing. It prospered in part because the founders, Bill Rayburn, Dennis Tosh, John Johnson and Bob Dorsey, had a good idea, and they hired smart people to work for them.

Rayburn, who was the company’s CEO, says they also had a little something else that gave them an edge.

Bill Rayburn (second from left) attends a trade show in the early days of the company. The original FNC logo, in the background, was designed to reflect the neural network concept of FNC or Financial Neural Computing.

“On Wall Street it’s called ‘street cred,’” Rayburn says. “Man, our street cred was off the charts. If we told somebody we were going to do something, we did it. Clients appreciated that. I had three at our last client’s conference tell me that everyone who has touched FNC has seen their careers soar because we had a lot of credibility.”

“Street cred,” a term widely used in pop culture, predictably translates to credibility in the streets, or in this case, a reputation for excellence within a particular industry. That cred is often hard earned.

“It’s not always a bed of roses, but you’ve got to do the right thing,” Rayburn says. “Clients see that. They make their decision when you’re down in the fire. Anybody can perform when things are going well. My co-founders had a lot of integrity, and they just delivered.”

Bob Dorsey gives a presentation in Oxford.

Rayburn and Tosh had built strong relationships with banks across the country. FNC was able to tap into that network and offer a solution. Dorsey and Johnson, who were economics and management information systems professors, respectively, had worked on the technical side of the idea with Duncan Chen (PhD 97), one of Johnson’s students, who went on to serve as FNC’s chief technology officer.

The idea took root in the wake of the savings and loan crisis of the 1980s and ’90s. The scandal of failing banks led to the federal government bailing out the Federal Savings and Loan Insurance Corp., which insured many failed S&Ls. The cost to U.S. taxpayers was more than $124 billion. Following the boondoggle, cash-strapped banks were looking for as much savings as possible, and FNC delivered a solution to them.

FNC employees pose for a photo during the 2001 annual meeting held at the Yerby Conference Center on the Ole Miss campus.

“I just knew these big banks needed us,” Rayburn says. “They had a big problem. With these big banks, once you perform, the word gets around. It’s a small club. We had one or two take a chance on us, and we performed like champs.”

The first client to use the system was Charter One Bank in January 1999. It worked well. From there, Washington Mutual and Bank of America saw the power of the technology and became clients. The company grew.

Johnson, who taught at Ole Miss from 1987 until leaving to work for FNC full time in 1999, says the idea was that the financial system could remove paper but also add efficiency to the process, resulting in great savings.

John Johnson shows off a solution at another early trade show. FNC’s second generation logo is displayed on the left.

“Taking people and paper out of the process is what really changed things,” Johnson says. “When we first implemented the system, Washington Mutual had in excess of 400 people over four offices. Then there were probably 40 people in four offices. They were able to do so much more with so much less.”

Johnson remembers signing a bank loan for $50,000 to help with capital to start the company. The founders had to come up with $50 million in capital overall to start it. With his financial liabilities on the project, Johnson knew anything less than success could have major consequences.

“Our success came through a lot of perseverance,” Johnson says. “I think if we knew we had to raise $50 million to begin with, we would have thought twice. I just remember going into the bank thinking if this thing is going down, I’m going to lose my house.”

UM Chancellor Emeritus Robert Khayat (BAEd 61, JD 66) remembers hearing about the idea for the company in the late 1990s in a Sunday afternoon meeting at the Lyceum with the founders. Backing the startup wasn’t a hard decision for the university’s leadership. Khayat knew the team was doing important work in an emerging field.

“All universities say our tripartite mission is education, research and service. We also qualified it when I was chancellor by saying ‘meaningful’ research,” Khayat says. “That seemed like meaningful research to me.”

The team’s dedication was memorable.

Ribbon cutting at the opening of FNC’s office on Van Buren Avenue in Oxford

“I had no idea it was going to become a multimillion dollar business, but they were really committed to it, and they worked many, many hours in addition to handling their regular responsibilities,” Khayat says.

He acknowledges the university’s endorsement of the startup helped with selling it to investors and banks that would use the software, but he also credits Rayburn for being a tremendous salesman.

Khayat admits he was somewhat shocked to see the company grow like it did and was impressed with the fundraising the staff did to get the project off the ground. Drawing major clients such as Bank of America to use the FNC so ware while the company was still young certainly got the former chancellor’s attention.

As the number of employees and salaries grew at FNC, Khayat was more and more impressed.

“The FNC story is a testament to the power of university research,” Khayat says. “It’s a classic example of the potential that bright, aggressive and hardworking faculty can do to really convert meaningful research at Ole Miss or other universities into something that is good for society and financially beneficial as well.”

In 1992, three years prior to that noteworthy day with the napkin, a new state law — the Mississippi University Research Authority — was created, giving universities the ability to facilitate and establish spin-off companies resulting from university research. The groundbreaking legislation provided a procedural and regulatory framework and served as a catalyst for researchers to extend their work into the private sector and benefit Mississippi’s economy.

“FNC is one of the very first examples of our faculty taking advantage of the innovative MURA legislation,” says Alice M. Clark (MS 76, PhD 78), interim vice chancellor for university relations, who served as vice chancellor for research and sponsored programs from 2001 to 2016.

“They are the living proof of how university research can directly translate into local community economic impact,” Clark says. “FNC is indeed a great success story, mostly for the forward-thinking founders and investors, and also for the university, the Oxford community and all the lives enhanced including those who came to Mississippi to be a part of this story and are now an integral part of our community.”

FNC was incubated on campus within the footprint of the Office of Research and Sponsored Programs, in space that is now Brevard Hall. The university and FNC negotiated an agreement to transfer the intellectual property to the company for commercialization, and the company made plans to move off campus.

Tosh says those first steps of support from the university and the investors were critical to the company’s success.

“We were fortunate to have a university and a chancellor who understood the importance of incubating a startup business within the School of Business, some angel investors who stood with us during tough times, and a group of investors who believed in us when we were raising money,” he says. “We greatly appreciate what each and every one of them did for FNC.”

FNC Park. Photo by Robert Jordan

Dorsey, whom Rayburn calls the most intelligent person he has ever met, was an economist by trade. He remembers believing the system would work but also knowing a major obstacle to success existed besides the terrifying failure rate of new startups.

“We knew it would work, but the question was whether we could sell it,” Dorsey says. “The sales challenge was significant. We had Bill Rayburn, who is a born salesman. He was very convincing when he was selling it. We followed that with the ability to perform and make it work. Once we had the reputation, the banks all talk to each other, and they knew we could perform.”

Eventually, the company moved to a site just off campus on Van Buren Avenue and later to its permanent home on Office Park Drive. There, the company flourished, despite some challenges.

Mississippi wasn’t fertile ground for tech workers, including programmers, so the company had to find ways to attract them and keep them. Some had offers to work for Google, which is one of the most sought-after tech jobs, as well as NASA and others, before coming to FNC.

The recruitment strategy included touting the quality of life and amenities offered by living in Oxford, and offering those top-flight programmers very attractive salaries and benefits. The retention strategy included getting the new employees involved in the community. The company built FNC Park for local families and company workers to get to know one another at recreational facilities there as well as FNC community events that helped the employees assimilate into Oxford life.

“We recruited top-rate people and wanted to keep them,” Rayburn says. “That’s why the community became important to us. We love the town, but we had a bigger motive. We wanted to get our people involved because the research indicates if you get your people involved in the community the chances of them leaving is much, much less.”

Jon Maynard, president and CEO for the Oxford-Lafayette County Economic Development Foundation, shared that FNC is the type of economic development that is a perfect fit for Oxford.

Bob and Carol Dorsey (left), Bill Rayburn and Lois Lovelady, John and Heather Johnson, Dennis and Beth Tosh, and Chancellor Jeffrey and Sharon Vitter. Photo by Kevin Bain.

“We are working on growing our community with businesses that embrace the culture and charm of our community,” Maynard says. “We encourage entrepreneurs who have ties to the university to grow their businesses in Oxford. They will benefit from the quality of the community and the resources available through Ole Miss.”

It wasn’t all smooth sailing. After they met the enormous challenge of raising the $50 million to get FNC off the ground, the company’s leaders discovered payroll taxes weren’t being paid. The company found the error and self-reported it. The IRS placed a lien on FNC until the taxes were paid.

“Everyone looks at what all we’ve done along the way, and they think it’s great,” Rayburn says. “They don’t look at the struggles. We were fortunate. We had some smart people, but we were very fortunate.”

In December 2015, it was announced that after 16 years as a major employer in Oxford, FNC would be sold to CoreLogic of Irvine, California. At the time of the sale, FNC was the leading provider of IT platforms for real estate collateral information and technology solutions, which automate appraisals and make sure the lender is complying with all applicable laws. Its platforms were used in work ow systems for 18 of the 20 largest banks in the United States at the time of the deal.

CoreLogic bought FNC for $475 million, and the new ownership has maintained local operations. The founders, investors, senior management and the university received generous financial rewards upon the sale of the company.

“These funds — a direct benefit of ‘spinning off’ university research into a successful new business — along with private gifts, are necessary for UM to be competitive as a flagship university,” Clark says.

Jan and Lawrence Farrington with Dennis Tosh (center)

Along with a number of other UM alumni, Lawrence (BBA 58) and Jan (BAEd 65) Farrington, of Ridgeland, were among the company’s early supporters and investors. Jan Farrington served on the FNC board.

“It’s a great story,” Lawrence Farrington says. “The four professors took this from company zero to touchdown with each one contributing their own expertise in this. If I still had 16 years ahead of me, I’d invest in it again.”

Though it was profitable for many, the sale wasn’t an easy call for the founders.

“I didn’t want to sell,” Rayburn says. “But I knew I was the chairman and CEO of the company, and I represented the shareholders, and Bob and Dennis were both 70 years old. They wanted out.”

Money aside, the decision has deeply affected the men who started the company.

“I didn’t think the sale would be emotional for me, but it was,” Rayburn says. “I walked away the day it closed and haven’t been back. FNC has some exceptional people, and I wish all of them well. They are outstanding. CoreLogic got a company with a wonderful group of very talented people.”

Chancellor Jeff Vitter is a strong proponent of the role of higher education in building up individual lives and communities.

“It is remarkable to see how FNC transformed an entire industry sector,” Vitter says. “Their story is a testament to the power of innovation, collaboration and research that are born on university campuses. We are grateful to the four founders for leading the way.

“They not only showed how it could be done, but helped our university gain invaluable perspective and lessons on how to enable future success in translating research into innovative products and economic growth resulting in stronger communities.

“With our continued commitment to fostering an atmosphere of discovery and creativity — hallmarks of higher education — I am confident we will continue to see other great success stories emerging from our university.”

By Michael Newsom. Uncredited photos courtesy of CoreLogic/FNC.

This story was reprinted with permission from the Ole Miss Alumni Review. The Alumni Review is published quarterly for members of the Ole Miss Alumni Association. Join or renew your membership with the Alumni Association today, and don’t miss a single issue.

For questions, email us at hottytoddynews@gmail.com.

Follow HottyToddy.com on Instagram, Twitter and Snapchat @hottytoddynews. Like its Facebook page: If You Love Oxford and Ole Miss…