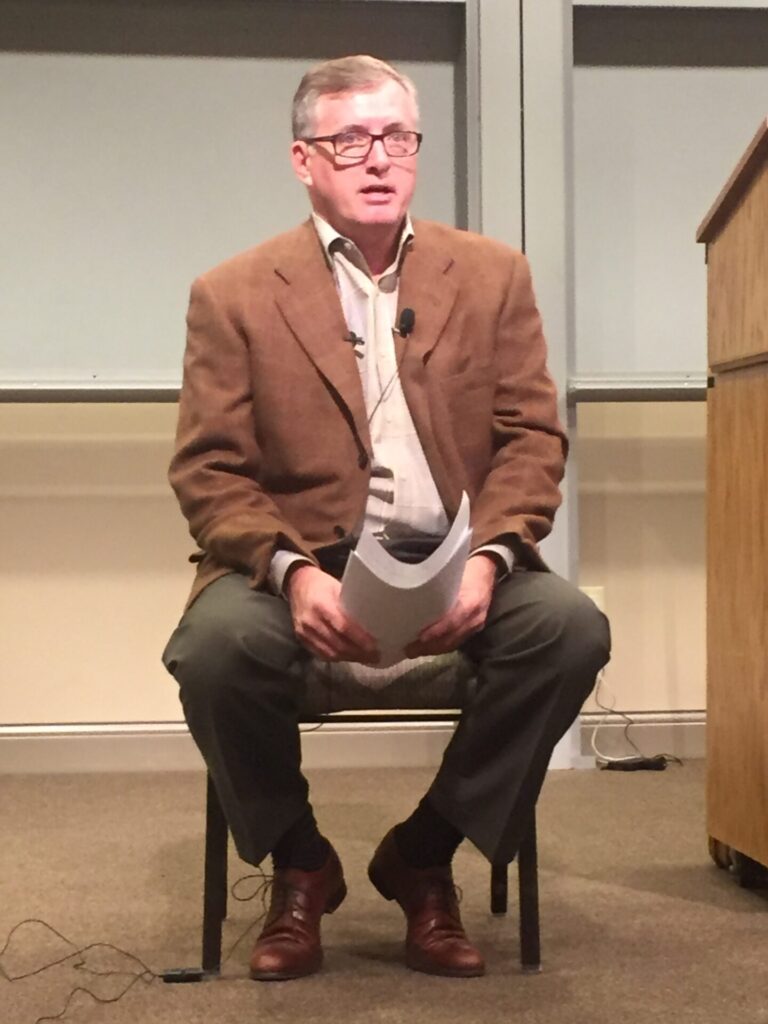

State Representative Jay Hughes proposed reforms for education and taxes in a town hall meeting held at the Oxford Conference Center Tuesday night.

Hughes, who represents Mississippi District 12, sought constituents’ input on several bills he aims to introduce in the House’s upcoming legislative session. The bills cover everything from eliminating the state’s grocery tax to getting rid of exit exams for high school seniors and replacing them with the ACT test.

Hughes also gave attendees a rundown of how the legislative process works and reviewed the complex system of deadlines that must be met.

The Mississippi Legislature’s 2018 regular session convenes Jan. 2.

Hughes is one of the legislature’s more outspoken proponents of public education. He said his proposal to switch to ACT testing instead of exit exams for high school seniors has bipartisan support in Jackson.

“Not a single college counselor or admissions program has ever asked you how you scored on your senior exit exams,” Hughes said. “We’re spending $110 million a year on a [testing] contract that came in on a boatload of lobbyists, and the reality is, it’s not solving anything. We’re already paying for ACTs for all Mississippi students in the 11th grade.”

Hughes noted his proposal would not eliminate benchmark testing in other grades.

Hughes also said he wants to see counties get a share of sales tax revenues. Both counties and municipalities collect sales taxes, but once that money is turned over to the state, only the municipalities get a share of it back.

For each dollar in sales tax collected, the state keeps 81.5 cents for the state budget and sends 18.5 cents back to towns and cities. “Counties don’t get any of that money back,” Hughes said.

Hughes wants to require the state to return 18.5 percent of county-generated sales tax revenue to the counties and to earmark that money for roads and bridges.

“They’re building Dollar Generals [in the counties] every 600 feet,” Hughes said. “We’ve got many different businesses that collect sales taxes that go 100 percent to the General Fund, to be wasted however we see fit down there [in Jackson]. That’s a lot of sales taxes going straight to a few people in Jackson, and, when I say a few, I mean the lieutenant governor, the speaker [of the House of Representatives) and the governor – that’s who decides, regardless of what we’ve learned in civics classes.”

Meanwhile, Hughes wants to see the sales tax on groceries – considered an especially regressive tax that disproportionately hurts lower-income people – eliminated entirely. “We have the highest grocery taxes in the U.S.,” Hughes said. “There are ways to move other moneys that are being wasted in other places right now to easily compensate for a grocery tax.”

He also wants to eliminate sales taxes on feminine hygiene products, noting the added expense “can be a real problem in some high-poverty areas.”

On other legislative issues, Hughes said he has introduced bills to create a state lottery and to make monetary donations to public schools tax-deductible, with the ability to earmark donations for specific uses.

He also called for the State Legislature to leave the Public Employee Retirement System (PERS) alone. As budget cuts continue to eliminate state jobs, fewer Mississippians are paying into the system, he noted. But PERS is currently stable and needs to stay that way.

“The legislature needs to stay out of it,” Hughes said. “Tweaks need to come from experienced members of the PERS board and financial advisors, not from lawmakers. You see what they’ve done with health care and education in Mississippi. The last thing we need is to give them a pot of $24 billion in retirees’ money.”

Rick Hynum is editor-in-chief of HottyToddy.com. Email him at rick.hynum@hottytoddy.com.