Featured

Delta Business Journal: Tourism Taxes In The Delta Bring Boost To Area's Economy

There is no doubt that the Mississippi Delta has something to offer everyone, especially its out-of-town, out-of-state and international visitors. From great music to outstanding food and friendliness among locals; the Delta’s tourism business is strong and vibrantly healthy. And the different percentages of tourism tax around Delta towns brings a boost to the area’s economy that is very significant and important in the scheme of things.

Lydia Chassaniol is state senator for District 14: Attala, Carroll, Grenada, Leflore, Montgomery, Panola Tallahatchie and Yalobusha counties in Mississippi. Chassaniol is also the chair for the tourism committee in the Senate and says that each town’s tourism tax may or may not be different.

“Our tourism tax in Winona is an extra two percent on prepared foods and beverages. And each town may be a little different when it comes to the percentages. I did the bill for Winona in 2016 and it was at the request of the mayor and the city council. And that two percent is on prepared foods and beverages only, such as McDonald’s or the Waffle House, places like that. Even at the grocery stores where they have a deli and people get plate lunches, the extra two percent is charged on prepared foods and beverages.”

Chassaniol adds that the plus side of this additional tax is multipurpose.

“The good thing is that this tax is used for tourism, but it also frees up a city’s budget. For example, our mayor had some streets that needed to be repaved and some other work that he wanted to get done, so instead of having to spend additional revenue on the recreational park or the tennis courts, things like that, he could do what needed to be done to the streets.

Of course, everyone probably knows the old saying, ‘Don’t tax you; don’t tax me; go tax that man behind the tree,’ but these are folks that are coming into town and who eat while they’re here. This is all pretty much just fast food, and our mayor was blown away; he couldn’t believe how much revenue was brought in since the referendum was passed and they were able to start collecting the tax. It’s just really freed up a lot of the other revenue, because it must be used on tourism projects. And I’m hoping it will generate other tourism opportunities.”

As tourism chair in the Senate, Chassaniol also deals with the alcohol issues.

“We have what one person has dubbed the “Go Cup” bill, which will allow patrons in special leisure and recreation districts to carry alcoholic beverages outside bars. All of the Delta towns’ senators asked for it. But, of course it will have to be approved by the mayors and city councils. For example, when these towns have festivals and/or downtown events, the “Go Cup” bill means that someone can purchase alcohol from a restaurant or other establishment and walk with it in the designated areas. The person will be restricted to that zone or particular area only. They can’t go wandering around just anywhere with it. So, there are safeguards in place. This makes festivals a little more appealing to people, similar to what they do on Beale Street. Certainly, no one is saying they want people to get drunk at our festivals; we have laws against that and against minors consuming alcohol, but this bill is designed for festivals and specific areas in these towns.”

Cooking School; I met with some of those folks recently, and we’re trying to figure out how to keep people in the Delta longer. They come into Memphis, and we want to keep them all the way down Hwy. 61. That’s my goal. And all you have to do is make tourism a user-friendly product and once you do that, people will use it.”

As Chassaniol points out, each town’s tax can be different. Dawn Davis is communications coordinator at the Yazoo County Convention & Visitors Bureau. Davis says the tourism tax Yazoo County collects applies to all hotels and restaurants.

“Yazoo County’s tourism tax applies to all hotels and all restaurants in the entire county. They collect a two percent tax. That two percent gets bundled to the State Tax Commission. They pay it and then they send to the State Tax Commission. And for our county, it goes to the Board of Supervisors, who in turn send it to the Yazoo County Convention & Visitors Bureau and it funds our office. Then according to the legislation that determines that, a certain amount also goes toward the Yazoo Parks & Recreation Commission.”

Coahoma County Tourism Commission’s Executive Director, Kappi Allen, says that in Clarksdale’s case, the tourism tax works with two different percentages.

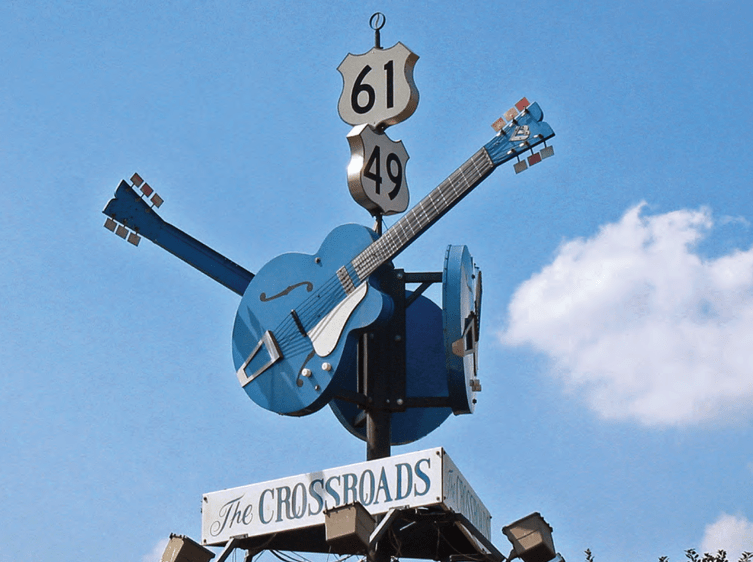

“Our tourism tax is two percent on hotel/motel and lodging and one percent on prepared food and beverage. And that funds advertising and marketing, administration costs; just everything. The majority of our tax collected goes for marketing, promotion and advertising. We tend to believe and think that Clarksdale is the hub within the Delta. And that’s certainly how we sell Clarksdale and Coahoma County to the world. We do have some wonderful attractions and when you come here and to the Delta; you literally come to the cradle of the Blues. It’s the birthplace and where it all began. We’re not bright lights/big city, and we don’t want to be, because that is not what’s authentic to Coahoma County.”

Judson Thigpen is executive director of the Cleveland-Bolivar County Chamber of Commerce and says that for the city of Cleveland, the tax is two percent.

“It’s two percent on hotels and restaurants and ours is called the Tourism and Economic Development Tax. The proceeds from that go directly to the City of Cleveland and they spend it on tourism and economic-related projects. And that tourism tax grows as we have more visitors and it’s more tax revenue for the city. It’s a true boon for our economy and a pretty substantial tax increase for our city, providing more revenue.”

By Angela Rogalski. This story was originally published in the Delta Business Journal.